K2 INFRAGEN INTRODUCTION

K2 Infragen Limited is an engineering, procurement and construction (EPC) company

EPC business has 4 segments

Water Infra, Railway Projects, Road Projects, Civil Construction Works.

Co started business operations in Uttar Pradesh and have gradually expanded to Karnataka, Rajasthan, Madhya Pradesh, Haryana, Odisha and Delhi. Co has also executed projects under the Bharatmala Pariyojna and the Jal Jeevan Mission.

Clients include prestigious names L&T, Adani Green Energy, TATA, HG Infra, Dilip Buildcon, KEC International, Vindhya Telelinks etc.

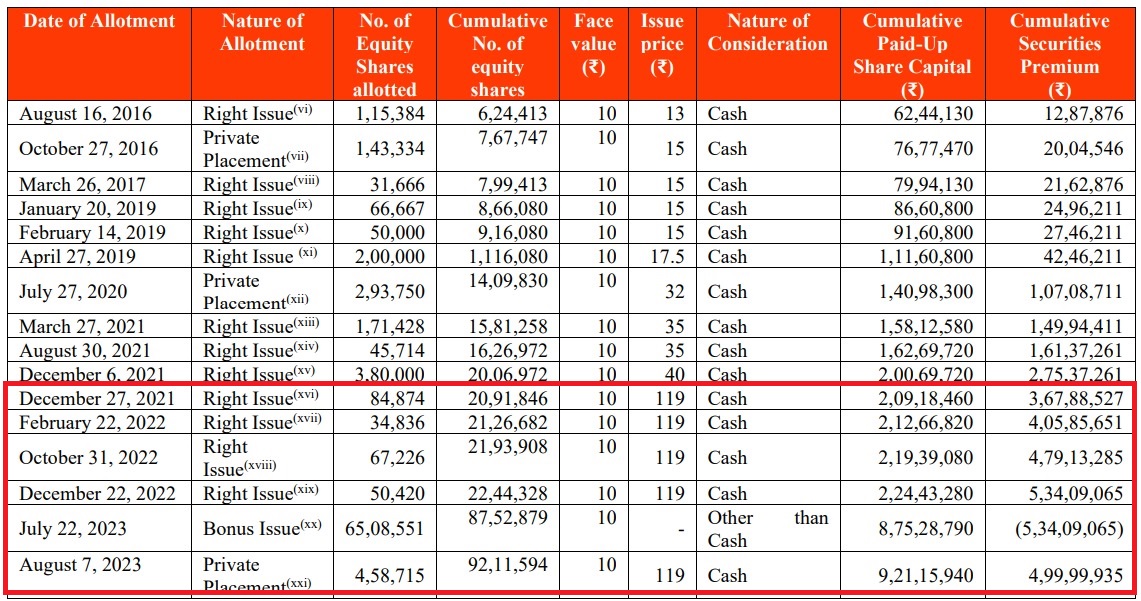

IPO

▪️IPO was entirely fresh issue of shares (No OFS from promoters)

▪️Indicates that even promoters are highly confident of future prospects

▪️Rights issue & Private placement happened at 119 per share during FY22, FY23 & FY24

▪️IPO issue price was also at 119 per share (Same price at which Rights issue to promoters & private placement was done

▪️Without being greedy promoters have left a lot on table for Retail investors as well

▪️Co listed at 167 indicating a 40% premium over issue price

▪️IPO was subscribed more than 46 times

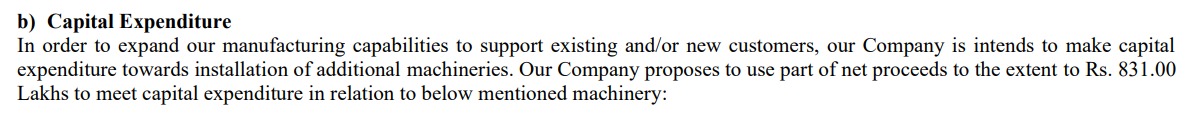

CAPEX

▪️Co will be utilising 8.3cr from IPO proceeds for CAPEX

▪️Purchase of Compactors, Rollers, Excavators, Pavers, Loaders, Transit Mixers etc will play a pivotal role as co will bid for larger projects

▪️There machinery will aid in the execution of the larger projects in a timely manner as well as Improve efficiency further

MANAGEMENT

▪️Mr. Neeraj Kumar Bansal, aged 53 years, is an Executive Director of the Company

▪️He has worked for companies such as G R Infraprojects Ltd, Shekhawati Transmission Service Company Ltd and TPG Constructions Limited

▪️He was also the President of Railways & Metro at HG Infra Engineering Ltd

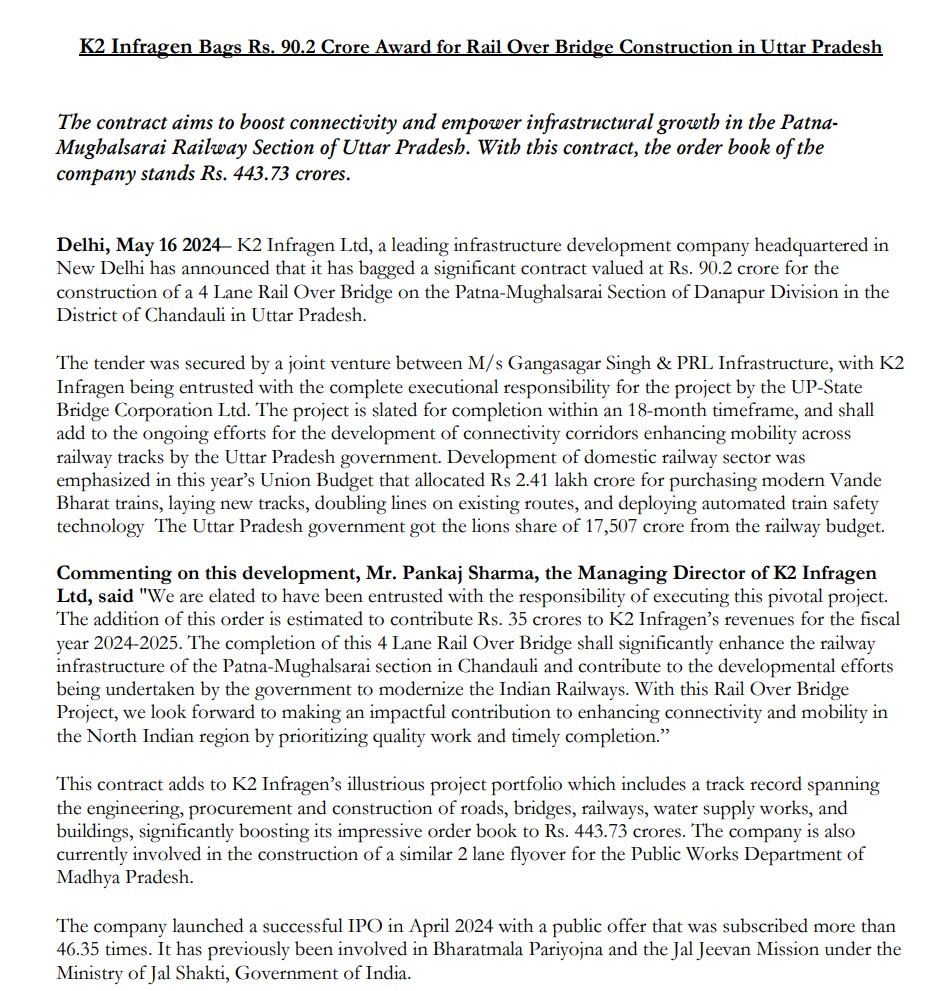

▪️Mr. Pankaj Sharma is the Founder & MD

▪️He is a seasoned entrepreneur

▪️His 1st Telecom venture “Ardom Telecom” was awarded with Fastest growing Technology Company of year 2013 in Deloitte Fastest 50

ORDER BOOK & OUTLOOK

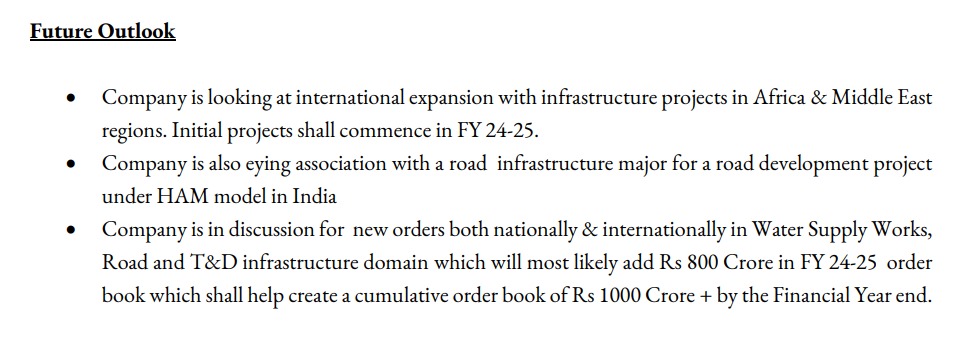

▪️Recently received a 90cr order for Rail Over Bridge construction in UP

▪️Current order book stand at 444cr

▪️Co expects to add 800cr+ worth orders during current FY, taking its Total order book to 1200cr by end of FY25

▪️For FY26 we estimate co to have an order book of 1700-1800cr

FUTURE PROSPECTS

▪️Co is currently in the advanced stage of negotiation with multiple large EPC players for the work orders

▪️Co is looking to expand its operations internationally as well

▪️Further, Co is also looking at leveraging government projects to drive further growth

▪️Govt infra projects like Bharatmala Pariyojna and the Jal Jeevan Mission provides an excellent opportunity to grow exponentially

▪️Huge orders will flow in from Water Infra projects

▪️Fresh capex for advanced machinery will help co to bid & execute bigger projects

ESTIMATES

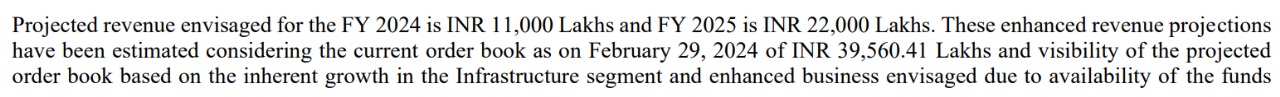

▪️In last 2 years co has tripled its Revenues from 37cr in FY22 to 109cr in FY24

▪️Co had guided for 110cr Revenues for FY24 and co met the guidance target

▪️Now co will more than double Revenues during FY25 to 250-260cr

▪️Co has guided 220cr Revenues for FY25, but we believe now co can do higher Revenues for FY25 as co has recently won another 90cr order that will add another 30-35cr Revenues in FY25

▪️Further, FY26E Revenues can be 400-425cr

👉We estimate FY25E PAT at 28cr & FY26E PAT at 48cr

VALUATIONS

▪️Trading extremely cheap at a P/E of just 13x FY25EEPS & 7.5x FY26EEPS

▪️Deserves to trade at 30x P/E

STRONG RE-RATING CANDIDATE

K2 Infragen Share Price

| Name | Today K2 Infragen Share Price Market closing |

| K2 Infragen | ₹307 Per Share |

Read More

100% रिटर्न सिर्फ 90 दिन में; PSU SHARE में मिलेगा जबरदस्त DIVIDEND March 2024 में, टारगेट ₹652